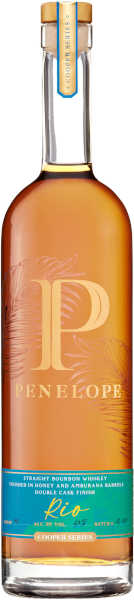

Penelope Rio 2024 Release

Penelope Rio 2024 Release

Straight Bourbon Whiskey Finished in Honey and Amburana Barrels Double Cask Finish

49% ABV

$90

Website

We would like to thank Penelope Bourbon and BYRNE PR for sending us a sample to review.

What the Producer Says

Rio is our latest installment in our Cooper Series which takes our straight whiskeys on a world tour, pairing Penelope with unique casks from around the world. Inspired by the joy of Brazil, Rio delights the senses with a double cask finish of American honey and Brazilian oak. The two make perfect dance partners, rich and sweet, with surprising depth. It’s a carnival in a bottle.

TASTING NOTES

Aroma: Sweet honey with a fun Cinnamon roll note

Forward Notes: Sweet spice

Body Notes: Gingerbread, honey nectar & sweet baking spice

Finish: Long and savory finish with subtle hints of sweet honey & spice

BOURBON FACTS

Type & Proof: Four Grain | Straight Bourbon Whiskey | 98 Proof | Non Chill-Filtered

Process: Blend of 3 bourbon mash bills comprised of four grains finished first in honey barrels and then new Amburana barrels from Brazil. Finishing period was ~2 years in total.

Age: 4-6 years

Mash Bill: 74% Corn | 14% Wheat | 9% Rye | 3% Malted Barley

What Gary Says

Nose: Cinnamon rolls with honey, vanilla frosting, graham cracker crumbles with a bit of caramel and nutmeg.

Palate: Creamy mouthfeel with honey, cinnamon, vanilla, caramel, nutmeg and a bit of pepper.

Finish: Moderately long, syrupy with cinnamon rolls and honey.

Comments: On the nose this doesn’t strike me as a “finished bourbon”. One of my pet peeves is when a finish overpowers the core whiskey, and that is the case here but . . . I really love it! As much as I want to critique the heavy handed finish, this is a delicious guilty pleasure. Sure, there’s some bourbon notes of caramel and vanilla tucked in there if you work at finding them, but the honey and cinnamon are center stage – and rocking it. If you want your bourbon to taste like bourbon, this could be disappointing. If you’re open to drinking what reminds me of honey slathered on freshly made cinnamon french toast (or a certain cinnamon roll drizzled in honey, you get the picture) – this is a really tasty treat!